4 Ways Mekorma Remote Payment Services Protects Your Business from Fraud

When it comes to the top things Accounts Payable professionals worry about, payment fraud is at the top of the list.

For good reason. You’ve got the money, and fraudsters know it. And as the landscape of B2B payment options grows more complex, so do the methods fraudsters use to target AP departments.

Outsourcing your AP payments with Mekorma Remote Payment Services (RPS) offers a solution you can’t find anywhere else. RPS provides multiple layers of security that add up to a complete fraud prevention program. Here’s how:

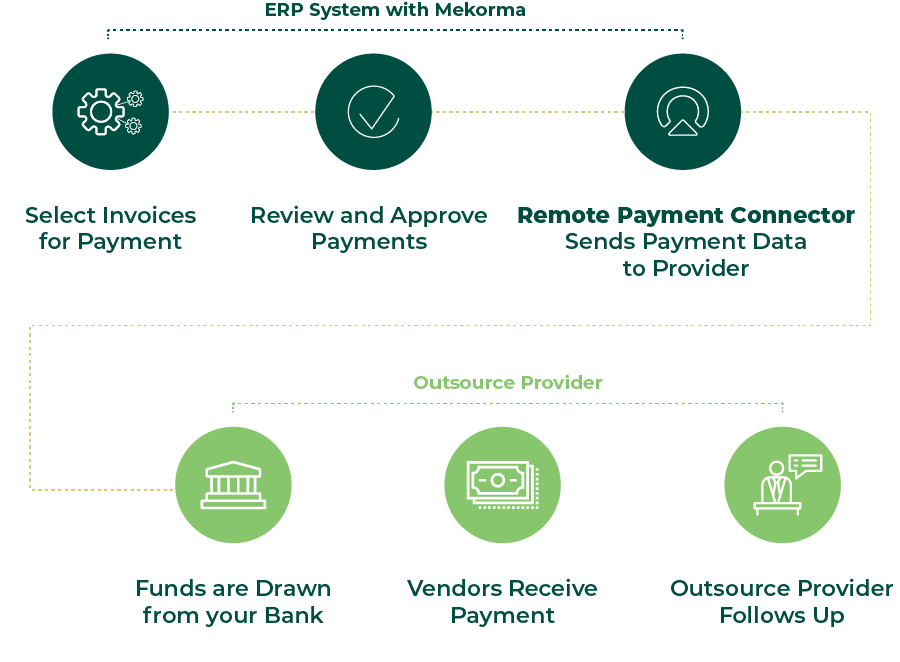

Maintain approval workflows within your ERP system

Whether you pay in-house or outsource, we recommend that you require payments to be authorized before being processed – even if the invoice has already been approved. A dual approval approach is the most secure.

With Mekorma Remote Payment Services, you can keep both approval processes within your ERP system. Payment approvals happen before the data gets transmitted to the payment provider, and you’ll have audit records within your ERP for maximum visibility.

For Dynamics GP customers, Mekorma task-based security offers flexible and fool-proof workflows that integrate and expand on GP security. This ensures that payments are locked down and cannot be sent to the outsource provider until designated users approve them in Dynamics GP or with the PowerApprovals mobile application.

Business Central users can implement BC native payment approval workflows to accomplish the same kind of controls.

Know Your Customer: Direct Vendor Validation

You all know that check fraud is the most common payment fraud type – but what about ACH?

It’s quite common for fraudsters to intervene via business email compromise by pretending to be a legitimate vendor. They will attempt to change banking information with your AP team so payments will be misdirected into a fraudulent account.

In the Remote Payment Services program, third-party data banking information is never accepted. If you as the customer try to change a vendor’s bank account and routing information, the outsource provider simply won’t do it until they’ve communicated directly with the vendor.

The outsource provider will then implement the Know Your Customer validation process. They will verify that the vendor is legal, registered in the United States, that their bank account is a legal bank account (also registered in the

United States), and other critical screenings. The vendor will be required to verify the amount of their last payment sent, along with associated invoices. It's very difficult for a fraudulent vendor to sneak through the system because the security

protocols are comprehensive and strict.

This protects you from any kind of business email fraud because your team can simply pass the vendor along to the outsource provider. A fraudster will think twice and most likely move on to other targets.

Payments aren’t made from your business account

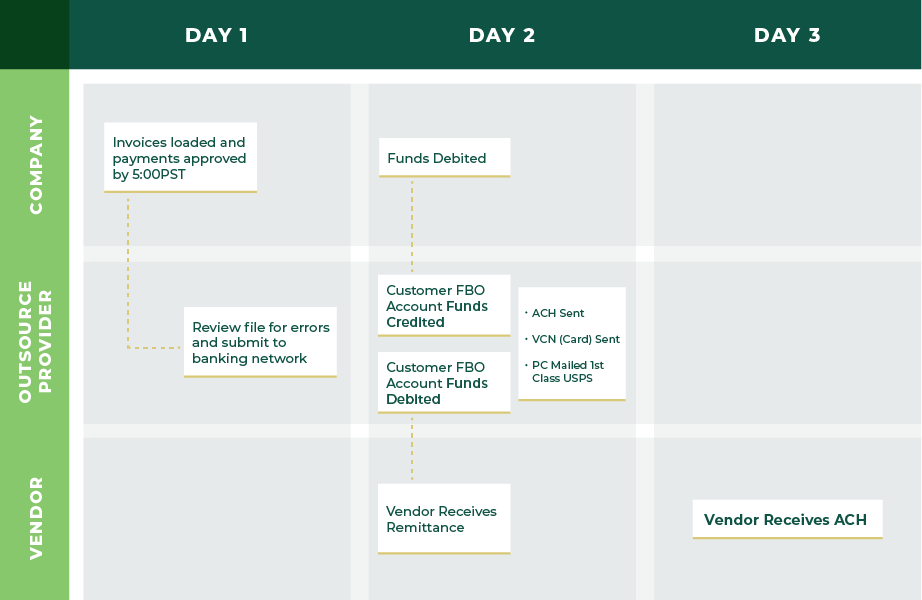

Instead of issuing checks or electronic payments from your bank account, Remote Payment Services has a unique way of handling payment flow.

The provider will first withdraw the funds from your business account and then transfer the money to a ‘For the benefit of (FBO)’ account. This account is maintained by the payment provider and all payments are sent from that account.

REMOTE PAYMENT SERVICES TIMING & FUNDS FLOW

This means your bank account information is never displayed on any payments, whether they’re sent via check, ACH, or virtual card. There is no trace of your sensitive financial information.

Pay with the Most Secure Payment Method

Virtual credit cards are hands down the most secure way to pay vendors. There's just no way to steal a “Vcard.”

A virtual credit card is a single use payment and can only be processed for a pre-determined amount. Not only that, but it must be processed on the designated vendor’s Point of Sale system. Even if a fraudster was somehow able to intercept the card digitally, they could not make a payment for more than the card was issued for, or pay anyone other than the intended vendor.

This is quite different than physical credit cards. If an employee with bad intentions or an external fraudster gets hold of your company credit card, payments could be made anywhere and in large sums depending on the credit card limit.

The Remote Payment Services vendor enrollment team works to convert your vendors to accept virtual credit card so you get this extra level of protection.

Conclusion

Payment fraud is a top concern of all AP departments across industry and size. Outsourcing your AP payments with Mekorma Remote Payment Services can protect your company in ways that aren’t possible if you’re paying in-house, or with any other third-party payment provider.