Guide to Remote Payment Services Pricing

Sending your vendor payments to an expert payment provider in the cloud can greatly reduce your risk of fraud and enable your team to work remotely. It can also relieve your AP team of tedious manual work and help you scale your business without adding headcount.

There are quite a few factors that influence what you will pay to outsource your vendor payments – and what you may get back in rebates. We can help create and carry out the solutions that give you and your team the best ROI.

Factors that determine the cost of Remote Payment Services

Costs

If you are considering Mekorma Remote Payment Services, your company’s payment volume and mix will determine your costs. There are several factors that determine costs:

- A subscription to Mekorma Payment Hub is required, as this is the base product.

- A one-time Activation fee

- Transaction Fees

- Potential monthly fees

- Minus Rebates and cost savings

In most cases, the cost savings of outsourcing and the rebates generated by vendors accepting virtual credit cards will more than offset your cost.

Transaction Fees

Transaction fees apply for checks and ACH payments sent. There is no charge for virtual credit card payments. See rebates section below for how virtual credit card payments can offset your costs:

- checks: $1.50 plus postage (est. at .69)

- ACH: $.95

- virtual credit card: free

Cost Savings

Comparing outsourcing costs and benefits to in-house payment processing offers significant savings

On average, your in-house processing costs will be between $4 and $20 per payment. To analyze what you currently pay to process payments in-house, factor in the following:

Per check cost for stock (pre-printed or blank)

Toner cartridge cost

Postage

Envelopes

ACH / wire fees, based on your bank’s transaction

ACH per-file submission fees charged by your bank, which can add up

The number of hours per week dedicated to processing (including batching, approving, hand signing, and sending payments), multiplied by the hourly wage of the people involved

Average losses due to fraudulent activities, internal or external

Managing payment returns

Vendor setup

Vendor payment method and profile changes

Stop payments

Monthly Network Services Fees

In addition to fees per transaction, the payment provider may charge a flat monthly fee for services. With Mekorma’s solution, there are no monthly fees for payment processing. This can be as low as $0 to $500 per month. On occasion, for particularly complex clients, this monthly fee can be higher.

Rebates Can Offset the Monthly and Transaction-Based Fees

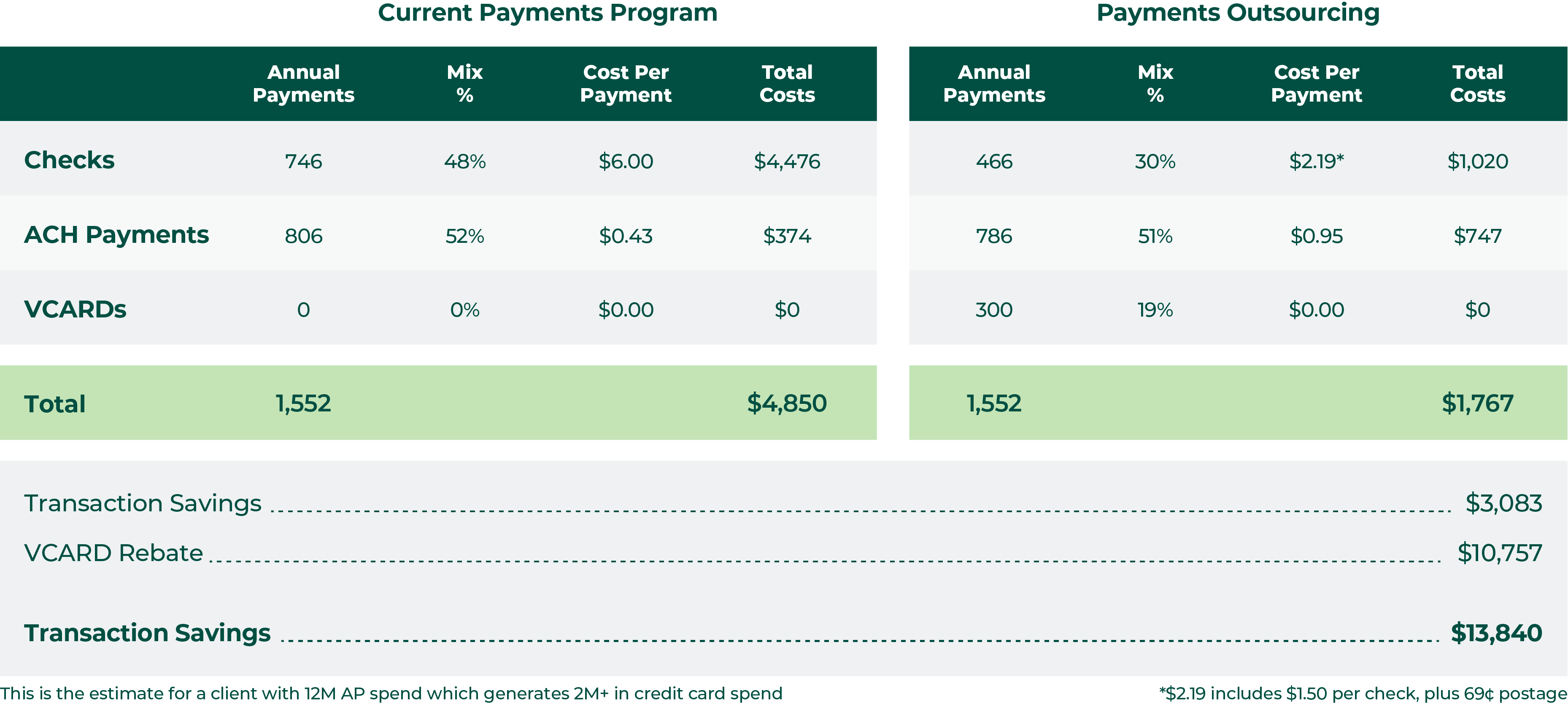

In the table below, you’ll see an example of the estimated ROI for a Mekorma client that processes 1,552 payments per year. The client currently spends roughly $4,823 annually to process payments in-house. Even though they send more ACH payments than paper checks, almost all their current costs are going towards printing and mailing paper checks.

The ACH fee of $0.43 is an estimate and this will vary depending on what your bank charges per transaction, for the file submission, and the average number of transactions per file submitted. Banks may say ACH costs $0.05-$0.25 per transaction, but they also charge a per-file fee – it can be as high as $10. And don’t forget the labor costs involved to process the ACH files.

With a remote payment solution, this client will cut their costs by 65% as soon as they start outsourcing. Their rebate potential for the year is more than $10,000 from payments made by virtual card. That still leaves them with an estimated upside of $13,854 per year.

One-time Costs

Activation

Activation of the Connector is a one-time fee of $2,500.

Our implementation plan includes:

- Kickoff meeting

- Assistance getting signed up and needed documentation

- Create plan with you for notifying your vendors

- Set a go-live date for first test payment

- Weekly team meetings for 2 months to check in on comfort levels

- Additional follow-up meetings monthly for the first 6 months

Activation includes five checkbooks as part of the configuration.

In addition to these costs, we’ll need to review your current system to see if you need to upgrade or desire any add-ons.

Core Platform

Do you already own our core payment platform (Mekorma Payment Hub) and are you on the latest version?

The Payment Hub is the foundation for our Remote Payment Services offering and ensures you have an efficient way to build and securely approve payment batches BEFORE they’re sent to the outsource provider’s platform.

The Remote Payment Connector is included with a Mekorma Payment Hub Subscription* and it allows your ERP to communicate with the payment provider’s platform.

In summary, we have a number of solutions that will help you optimize your accounts payable and payments processing to maximize your ROI. We’re here to discuss which solutions will work best for you and your team.

The Benefits of Remote Payments for Dynamics GP Users

In today’s ever-changing world, financial professionals have to move beyond the familiar habits of sending paper checks and move to safer, more efficient payment methods.

If you run your AP processing within Dynamics GP, outsourcing your vendor payments with Mekorma’s Remote Payment Services offers the following benefits:

Dynamics GP remains your system of record.

Payments are still processed, approved and posted into GP using our Action Board for robotic batch processing and payment approval workflow to streamline approvals in advance of sending payments for processing.

All file and payment transfers are fully automated and seamlessly handled without adding additional steps.

You maintain complete control over what vendor payments are sent out and any you wish to print in-house.

The outsource provider fully indemnifies all payments sent via their services. Continuous onboarding, vendor payment inquiry services, and vendor portals are available to those receiving electronic forms of payment.

A payment portal for your Accounts Payable department is also provided for additional visibility into the payments sent through the service.

Accounts Payable maintains complete control all while freeing themselves from the burden of:

Fielding vendor inquiries

Managing and securing vendor banking information

Stuffing and mailing checks

Fraudulent payment research and recovery