4 Practices for Signing AP Checks: Best and Worst

Check signing - It’s one of those important tasks that must be done, or someone doesn’t get paid. As a business, you want to pay your vendors on time, and sometimes inefficiencies in your check signing process can throw things off track.

So, what are the best and worst practices when it comes to putting your John Hancock on those important pieces of paper? Let’s break them down.

Practice #1

Worst: You’re the only check signer

If the AP team relies on you as the only signatory, it can be stressful for everyone involved. You have the pressure of knowing you must be physically present in the office, and AP gets stressed if they’re not able to process payments on schedule.

Best: Authorize trusted others to sign checks

It’s best practice to authorize a trusted individual in the organization to sign checks.

Delegation to others can be the best thing for you and your business, as long as you have strict security rules backed up by your AP software. This gives greater responsibilities to others while freeing you from being chained to the pen.

Practice #2

Worst: Leave a stack of checks on your desk unsigned

If you’re the only one signing the checks, chances are there is a stack of them waiting on your desk. Do you have time to review them? The last thing you want to do is upset vendors or worse have someone without oversight or authority take it into their own hands.

Best: Implement a digital check signature solution

Get rid that stack of paper checks, and you’ll have the flexibility to ‘sign’ checks from anywhere. In our last blog, we discussed the 5 Signs It’s Time to Move to e-Signatures.

A good e-signature solution will make your check printing workflow easier and more secure.

Practice #3

Worst: Do the same thing every time...or forever

When running a business, we often get stuck in our ways or do the same thing for a long time without assessing or updating processes. We take comfort in familiar ways – like hand-signing checks every week - even if they’re not the most effective; or we don’t realize there’s a more streamlined way.

Best: Audit your process to see where you can improve

It’s so important to audit your business systems and procedures. Ask the various departments for feedback on what’s working well and what isn’t. Where are the gaps or ways to streamline processes?

The AP department is a great place to start. List the things that you and your AP department are having challenges with. Document your existing processes and see if there are ways to make them better.

One example is adjusting the check printing workflow in this way:

- Approvers (check signers) do not need to be physically present to sign - they can approve payments remotely.

- The approval workflow applies to all payments, so your electronic payments also get approved - not just your checks!

- Executives are freed from the labor of hand-signing payments.

A quicker payment cycle - the timeline for check approvals and signing is reduced.

Practice #4

Worst: Spend time signing or stamping checks individually

Your time is valuable. An electronic signature solution that ties in with your ERP security rules can save you the effort of picking up a pen and manually signing checks one by one.

Even if you’re not using a pen, perhaps your staff is taking similar steps to hand-stamp signatures. Unfortunately, it’s easy for would-be fraudsters to copy a signature made with a rubber stamp to sign unauthorized checks. This can lead to check fraud and your company would be liable for 100% of the loss.

Best: Incorporate e-signatures to streamline and save time

By incorporating all the best practices above you’ll see that hand-signing a check is not a best practice, there’s an easier way. It can help:

- Alleviate late payments

- Stop the pile of checks on your desk

- Give power across your AP department

- Create a more efficient process

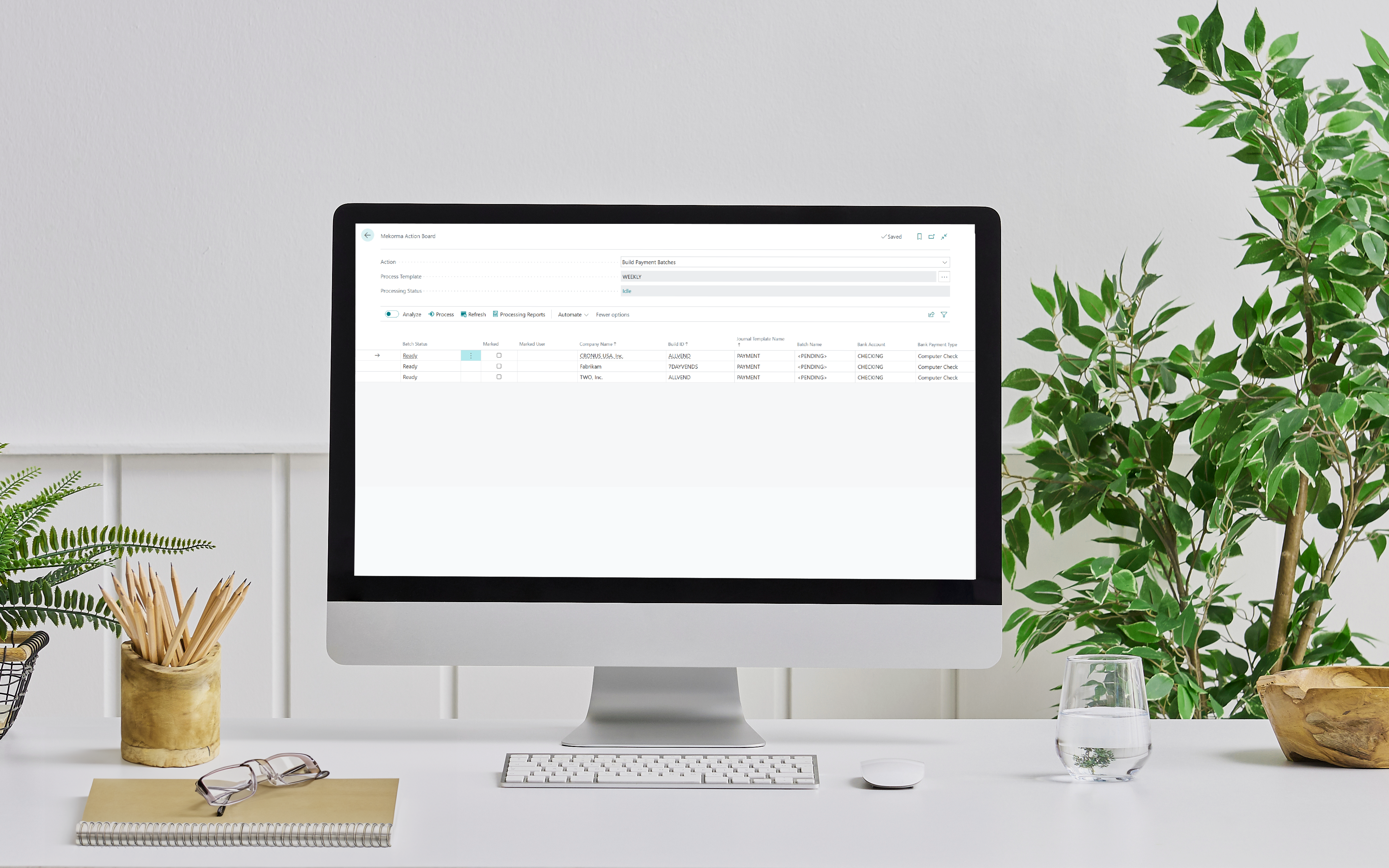

Save yourself time and effort with Mekorma Electronic Signatures. Review payments and digitize invoice images within your ERP. With the click of a button, you can approve what’s ready to go out – checks will print with the appropriate signature, no pen required.

Mekorma Electronic Signatures works with Microsoft Dynamics GP as part of the Payment Hub, or you can get the free tool for Microsoft Dynamics 365 Business Central.

And now Electronic Signatures works with Acumatica Payment Approval workflow to relieve approvers from the manual work of reviewing and signing checks. The best part - you can get started today, for FREE! Contact us today!